Season’s Greetings! As we revel in the winter festivities, it’s crucial to mark December 31st on your calendar for important Maui property tax considerations that can help you save money.

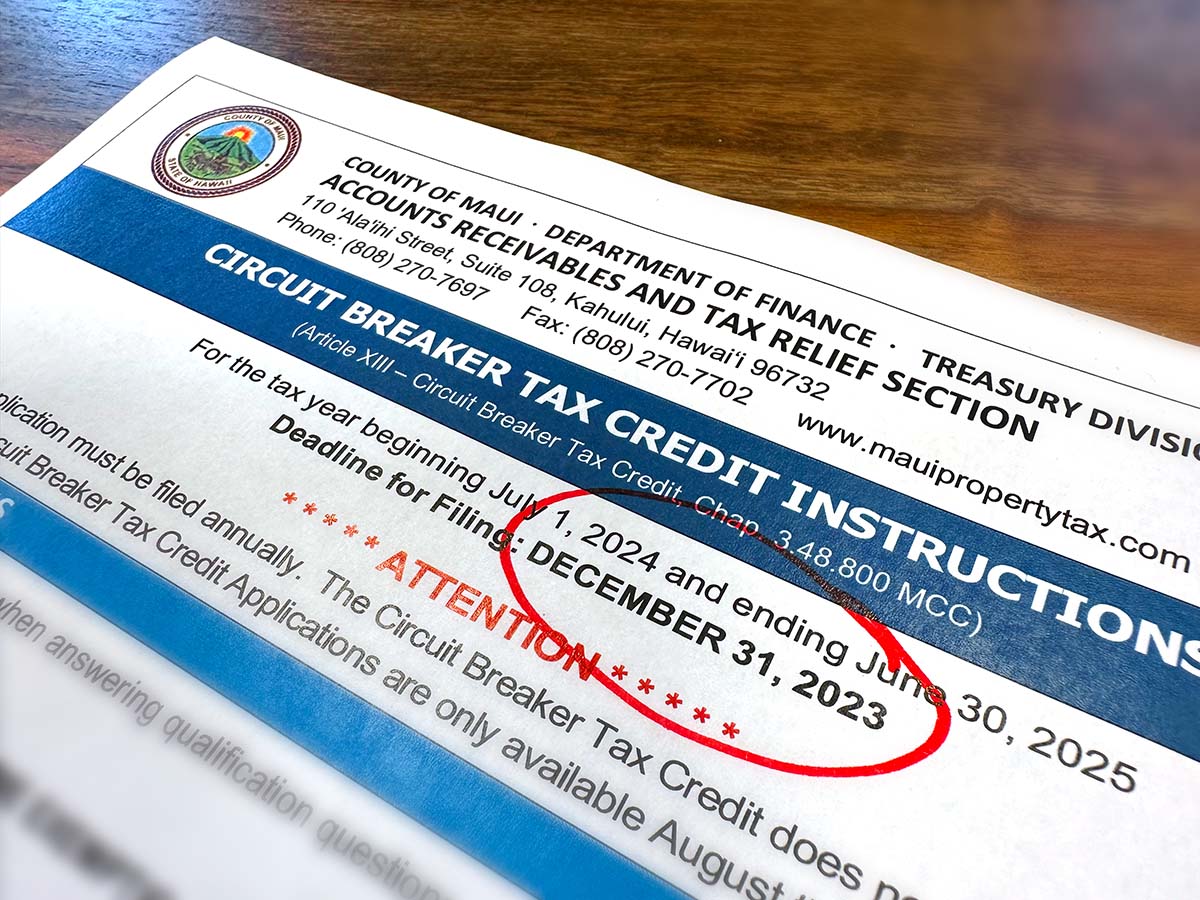

Firstly, this date serves as the deadline for filing circuit breaker applications for the upcoming fiscal year. The Circuit Breaker Program extends tax relief to eligible taxpayers, providing a credit on real property taxes for their primary residence. To participate, applicants need to complete and submit the required application form to the County of Maui Department of Finance Real Property Tax Division.

Secondly, December 31st is also the cutoff for filing exemption claims and ownership documents. The home exemption program, designed to reduce taxable assessed value by $200,000, reclassifies the property into the Homeowner class for tax rate purposes. Additionally, the long-term rental exemption offers a real property exemption of up to $200,000 for a parcel occupied as a long-term rental for twelve (12) consecutive months or more by the same tenant.

For a comprehensive list of all tax relief program exemption forms, visit https://www.mauicounty.gov/1953/RPA-Forms-and-Instructions

We trust that this information proves helpful. Should you have any further questions or require additional assistance, feel free to reach out. Wishing you a prosperous and tax-efficient New Year!

Anthony Sayles R(S)

Direct mobile: (808) 280-6532

Anthony@DanoSayles.com